Hey Hisa Fan,

We took a bit of a look on markets last week, and this week we move step by step to see the investors. You know, in every market we have to understand the investor because their behavior largely determines the kind of activity on the market and regulations surrounding that market.

The Lazy…

The first stage of investing is known as Pre-investing, some might call it the “ignorance stage” but we just call it the lazy. These are the people who have no interest in the value of money, they see no sense in investing and always have the You Only Live Once (Yolo) tag wherever they go. When the Yolo Investor gets funds, they always want to use it like there’s no tomorrow.

The main cause of Yolo Investing or Pre-Investing is the lack of knowledge on personal finance and investing.

The Set…

Then we have these guys, they are set to invest, they get the information and will always want to make returns form every penny/shilling they invest in but they have one weakness.

Inadequate Data - They make investment decisions are based on weak fundamentals, they do not rely on their research but more on the news, they are always reading the news and trying to make every move work.

Speculators - The speculators are the guys who think they’re the pros but they aren’t. Well, speculators “move with the wind” basing their investments on speculation. You see, speculation is the hope that a stock will go up when you buy it, it that “gut-feeling”, most often, buying in because people are buying.

Here’s an example, you can buy Stock A at $1 per share, and hope that the share price goes up to $2 per share so you make profit.

Easy-peasy, right? Well, we got some bad news! Over 90% of the speculators get it wrong and loose money in the market. The upside is, 10% of them make returns!

The Master

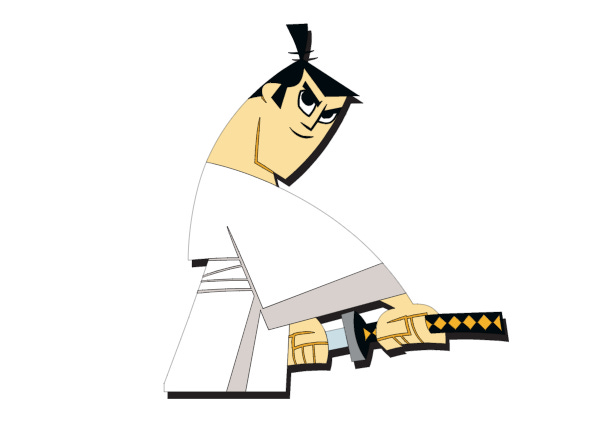

Remember Samurai Jack Vs the Ninja Worriors & Aku? If you remember, who was the Master? We know you know this guy.

The Masters are the traders, the pros on the markets, they take various angles of investing. They get the data, back all their investments with a data piece before making the move. The Samurais of investing or Active Investors take calculated risks which in turn can give returns.

In most cases, they have a long term outlook on the area they invest in, this could be in stocks, bonds, derivatives, real estate e.t.c.

Active investing involves taking charge of various metrics or ratios before investing. Most of the time, it involves high net worth (HNI) individuals but trust me, everyone should ultimately turn to active investing.

I mean, who doesn’t want to be like Samurai Jack, for us at Hisa, we definitely would love to beat the returns our of our investments.

Too much to start the week, but here’s a question. What kind of Investor are you?

What Cowries will we be collecting this week?

AMC Craze - The wall street bets have been roaming global markets this week, AMC moved 116% during the week and bets are turning on wall street to see if the “diamond hands” will continue or they’ll be off the hook and continue profit taking that began in late trading Thursday.

The G7 Summit - The G7 holds their summit later this week, covering on various socio-economic issues affecting some of top economies globally. G7 which consists of some of the wealthiest and powerful nations. Investors are hoping for good news, mostly from European partners who have had cycles of lock down since the coronavirus began in late 2019.

Nation Media Group - That’s right, NMG still on our cowries watch this week, we take a closer look on if the stock will continue to perform amidst a share buyback happening on the market. NMG was the week’s top gainer on the NSE, with a 30% gain. Will this gaining streak continue?

Get the Hisa App on Google Playstore or App Store on iOS and join out community of investors.