Swings, Speculation, Volatility and the Ukraine Tension

A long January finally comes to an end, but tension still grip the markets.

Hello Hisa fans,

Thank you for joining us. As usual, another chance to pick out what stood for us in the last week for the markets. And what to look for this coming week.

Volatility

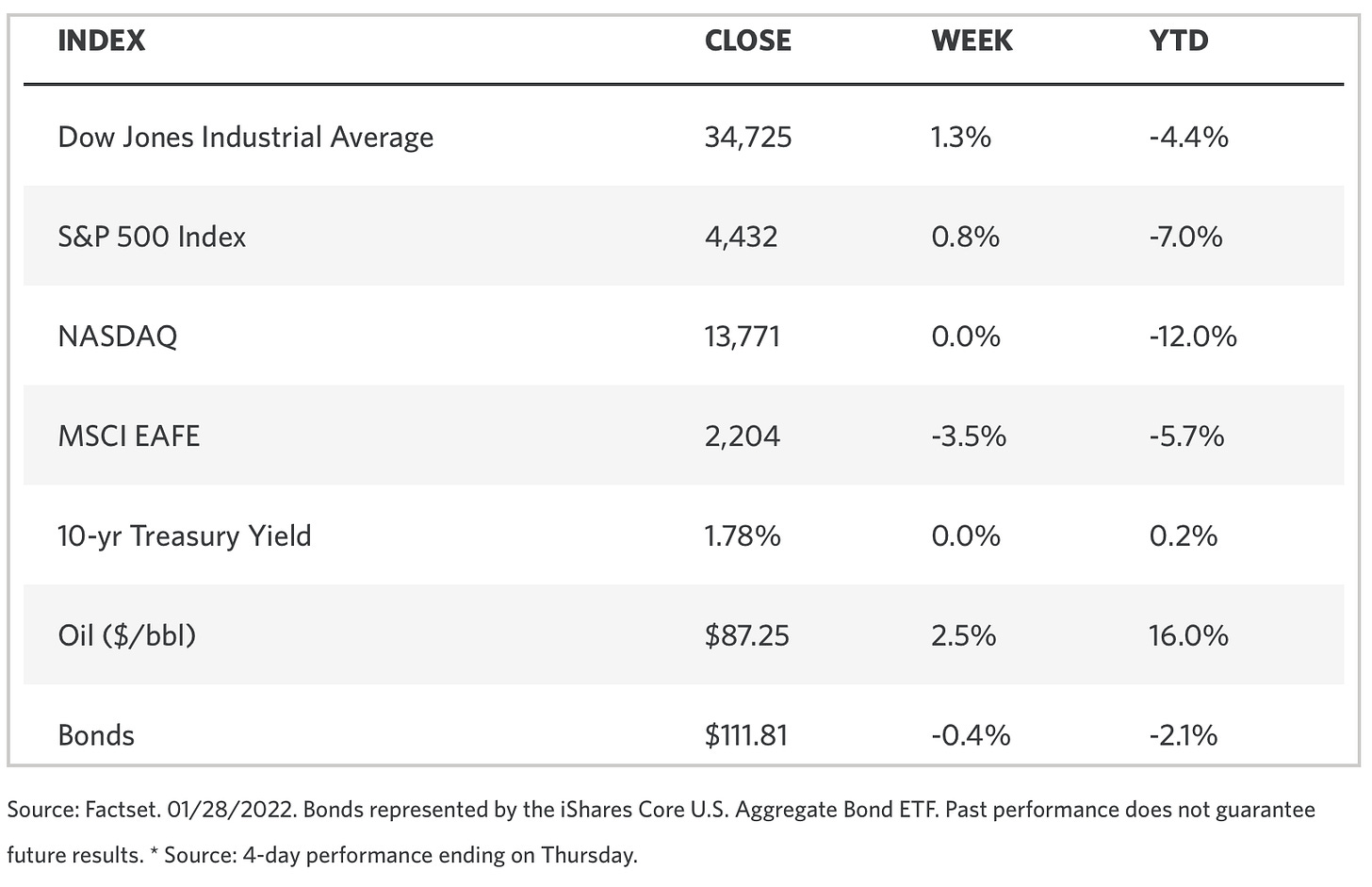

If we were to pick the new buzzword taking over from transitory, then volatility has to definitely be in the early lead. The first 3 weeks of the year came with consecutive declines in all the major indices. Last week reversed that trend slightly but we are still in the red, year to date. The Dow Jones gained 1.3% to cut its YTDD loss to -4.4% with the S&P gaining slightly (0.8%) for the week. We expect this volatility to continue as more companies in the S&P 500 release their earnings.

Last week’s Federal Open Market Committee meeting by the Fed confirmed what we’ve all been thinking for a while. The Fed will likely move to raise US interest rates in March in a bid to curb inflation. An increase would be a key step in reversing the covid-era, low-rate policies that have fuelled growth but have also escalated inflation.

With inflation well above 2 per cent, and a strong labour market, the committee expects it will soon be appropriate to raise the target range for the federal funds rate - the Fed's rate-setting Federal Open Market Committee said in a statement.

Analysts at Edward Jones expect the Fed to move more aggressively in the early months of its tightening cycle – perhaps a 0.25% rate increase at every meeting – and then a more gradual pace as they assess the economic environment.

Looking east, key Asian markets will be closed this week in celebration of the Lunar New Year holiday.

Oil heading to $100?

Crude Oil traded at about $94.18 per barrel on Jan 26th, a 7 year high from levels last seen in October 2014. This has been a steady increase from the $65 price on 2nd Dec 2021 promptly many analysts and speculators alike to conclude that we might see it cross $100 per barrel. Not so fast though, Forbes senior contributor, Michael Lynch, discusses the sentiments here in an article title The Next Oil Crash.

On their part, OPEC+ will meet on Feb 2nd to discuss March production. Analysts expect them to ratify the scheduled output hike of 400k barrels a day. Another key driver of oil prices this quarter will be the tension between Russia and Ukraine.

Geopolitics

There has been a brewing tension in Ukraine as Russia moved as many as 100,000 troops to the Ukraine border. This has attracted stern warnings from the US president Joe Biden and several European leaders of adverse consequences should Russia move on with an invasion into Ukraine. Ukraine had earlier warned that Russia was trying to destabilise it with military invasion. As the US and NATO responded by moving troops nears the Ukraine border, Russia President Putin in a call with his France counterpart Emmanuel Macron, said they had both ignored their main security concerns, but promised to continue talks with the west.

In the short term, the conflict if it escalates, is expected to greatly affect the prices of commodities especially oil, gas and metals. Russia is a top producer of oil, gas and metals such as palladium and platinum. Palladium prices have already gained about 15% this year while platinum has gained by nearly 7%.

The ongoing tensions will also continue to increase the demand for safe havens like gold and silver.

Earnings Releases

With only 33% of the S&P 500 having released their results, we are still along way in this Q4 earnings season. We anticipate a lot of activity between Tuesday and Thursday as Alphabet, Meta and Amazon headline the daily releases. So far earnings growth for the quarter has come in above expectations, at about 24% year-over-year.

What Other Cowries are We collecting?

As we finally move into February, the story so far has been the volatility on the markets. This doesn’t mean we will stop collecting our cowries though 😏. This week we scour for:

Draftkings ($DKNG), Caesers ($CZR), Penn National Gaming ($PENN), $MGM - Sports betting craze hits the US - at the peak of it’s power,

Kenya’s biggest sports betting platform Sportpesa was allegedly raking in close to Kes 10 billion ($100m) monthly in betting volumes. Seems crazy, right? We thought so too until we looked at New York. After passing legislation for mobile betting, New York recorded over $1.1bn in betting handles, in just 2 weeks 😳. New York has recorded more than $1.1 billion in total online sports wagering handle in just over two weeks of legal mobile betting, state regulators reported today. New York's January 2021 will be the all-time single-month record for sports betting handle for any state.

New York has recorded more than $1.1 billion in total online sports wagering handle in just over two weeks of legal mobile betting, state regulators reported today. New York's January 2021 will be the all-time single-month record for sports betting handle for any state.And the betting frenzy seems to have only one way to go, up. Ontario is expected to commercially launch online casino gaming, including mobile sports betting on April 4 making it the second-largest North American jurisdiction to allow legal mobile sports wagering.

Big Tech ($AAPL, $MSFT, $AMZN, $GOOGL, $META) - After last week’s earnings reports by Microsoft and Apple which saved the markets from further slides, we look forward to this weeks major tech stocks earnings. We anticipate Amazon, Alphabet and Meta to all outperform analyst expectations and post higher earnings growth but as we have seen with Tesla, watch out for any slight side news that might drag the stocks down.

NSE ($CIC, $JUB, $BRIT, $EABL) - East African Breweries Limited reported stellar H1 results buoyed by reopening of bars after covid. The company also reported a 185% jump in cash in had to Kes 7bn leading them to recommend an interim dividend of Kes 3.75 per share. Key dates for $EABL shareholders: 28th Feb for the book closure and 27th April for the dividend payment.

Last Monday we mentioned looking at the insurance sector after Sanlam Kenya issued a profit warning. Liberty Kenya have since followed up with a profit warning of their own. The insurance sector remains one to monitor keenly as we near the earnings reporting season due to the huge defaults on premiums as people were laid off or salaries cut during the pandemic.

Some dividend stocks (Realty Income ($O), Home Deport ($HD), Starbucks ($SBUX) - For all our fellow dividend hunters out there, we are starting a small segment to share with you stocks that pay out dividends. Obviously, you have to consider their dividend yields when doing your research. $O is an easy pick because they pay dividends every month having recently announced its 114th common stock monthly dividend hike since the company’s NYSE listing in 1994. The company paid 24.65 cents per share in dividend on Jan 14th 2022 compared to 24.6 cents paid in Dec last year.

That’s it from us at Hisa this week. A little Easter egg for all the loyal Hisa fans, we have some major news this week. We bet you will love the announcements 😊

Interested in trading US Stocks from Kenya? Download Hisa App today and own part of your favourite companies.

Disclaimer: The writer of this article owns $AAPL, $F, $O, $HD and $MSFT shares. This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision.