🚀Nvidia's Moonshot! Chipmaking and the AI Millions.

While novice investors look at volatile times as a time to pack and run, legends look at volatile times as an opportunity to find best entry prices and carry the bag home.

Hey Hisa fan,

Markets have a volatility feature which we a lot of investors always try to look on. While novice investors look at volatile times as a time to pack and run, legends look at volatile times as an opportunity to find best entry prices and carry the bag home.

For U.S Markets regular Q1 earnings season is essentially over. During the course of last week 14 S&P 500 companies reported 1Q23 earnings with 13 of them beating analysts estimates.

Key Earnings Brief.

Nvidia Corporation [NASDAQ: NVDA 0.00%↑]

The world’s most valuable chipmaker posted earnings of $1.09 per share on revenue of $7.19 billion for the fiscal first quarter ended April 2023. The consensus earnings estimate was $0.91 per share on revenue of $6.52 billion.

Nvidia’s data center group reported a 14% annual increase in sales at $4.28 billion, versus expectations of $3.9 billion.

The company’s automotive division (chips and software) grew 114% year over year.

Net income for the quarter was $2.04 billion, or 82 cents a share, compared with $1.62 billion, or 64 cents, during the year-earlier period.

The gaming division, including graphics cards for PC sales, reported a 38% drop in revenue to $2.24 billion.

Nvidia stock is up by 172.06% so far in 2023!

Nvidia said it forecasts sales of about $11 billion, in the current quarter, this estimates stands more than 50% higher than Wall Street estimates of $7.15 billion.

KCB Group Plc [NSE: KCB]

KCB Group Plc posted a Profit After Tax (PAT) of KES.9.8Bn in 1Q2023, a 1% year-on-year decline compared to the KES 9.9 Billion posted in 1Q2022.

Total Assets jumped 33.3% from KES.1.2 trillion to KES.1.6 trillion mainly attributed to a 31.9% expansion in loans and advances.

The group’s holdings in Government securities was up 0.4% from KES.251 billion to KES.252.1 billion.

Total Interest Income for the group jumped 26.3% to KES.33.6 billion as loans and advances jumped 31.4% from KES.18.8 billion to KES.24.7 billion.

Non-Funded Income (NFI) jumped 59.1% to KES.14.8 billion fromKES.9.3Bn 1Q2022 mainly due to a 52.9% growth in Forex trading income.

KCB Group Plc did not declared any interim dividend for the period in review.

KCB’s management’s revised their FY2023 earnings guidance with the company now forecasting a 10.4 - 10.9 growth in asset quality for the full year.

Other Key Earnings Updates.

Costco Wholesale Corporation [NASDAQ: COST 0.00%↑] - Cosco posted earnings of $3.43 per share on revenue of $53.65 billion for the fiscal third quarter ended May 2023. The consensus earnings estimate was $3.32 per share on revenue of $54.62 billion. The company’s total revenue for the third quarter was $53.65 billion, compared with the estimates of $54.57 billion.

Zoom Video Communications [NASDAQ: ZM 0.00%↑] - Zoom posted earnings of $1.16 per share on revenue of $1.11 billion for the fiscal first quarter ended April 2023. The consensus earnings estimate was $0.99 per share on revenue of $1.08 billion. Quarterly sales in its enterprise business rose 13% to $632 million. The company now expects annual adjusted profit per share between $4.25 and $4.31, compared with an earlier estimate of $4.11 to $4.18.

NCBA Group Plc [NSE: NCBA] - NCBA posted a 50% year-on-year growth in profit after tax (PAT) at KES 5.1 billion. The group attributed the growth to a substantial 68.8% uptick in the bank’s forex income. The group’s earnings per share (EPS) was up from KES 2.07 in 1Q22 to KES 3.08 in 1Q23. NCBA did not declare any interim dividend for the period in review.

Coffee Break.

Kenyans have been all in, discussing the proposed finance bill 2023. Well, one of the top area of concern amongst Kenyans has been the housing fund. Last week, Kenyans saw the President and the Housing PS Charles Hinga all come out to defend the housing levy. Here is an explanation by P.S Hinga on the levy. What’s your take?

Markets.

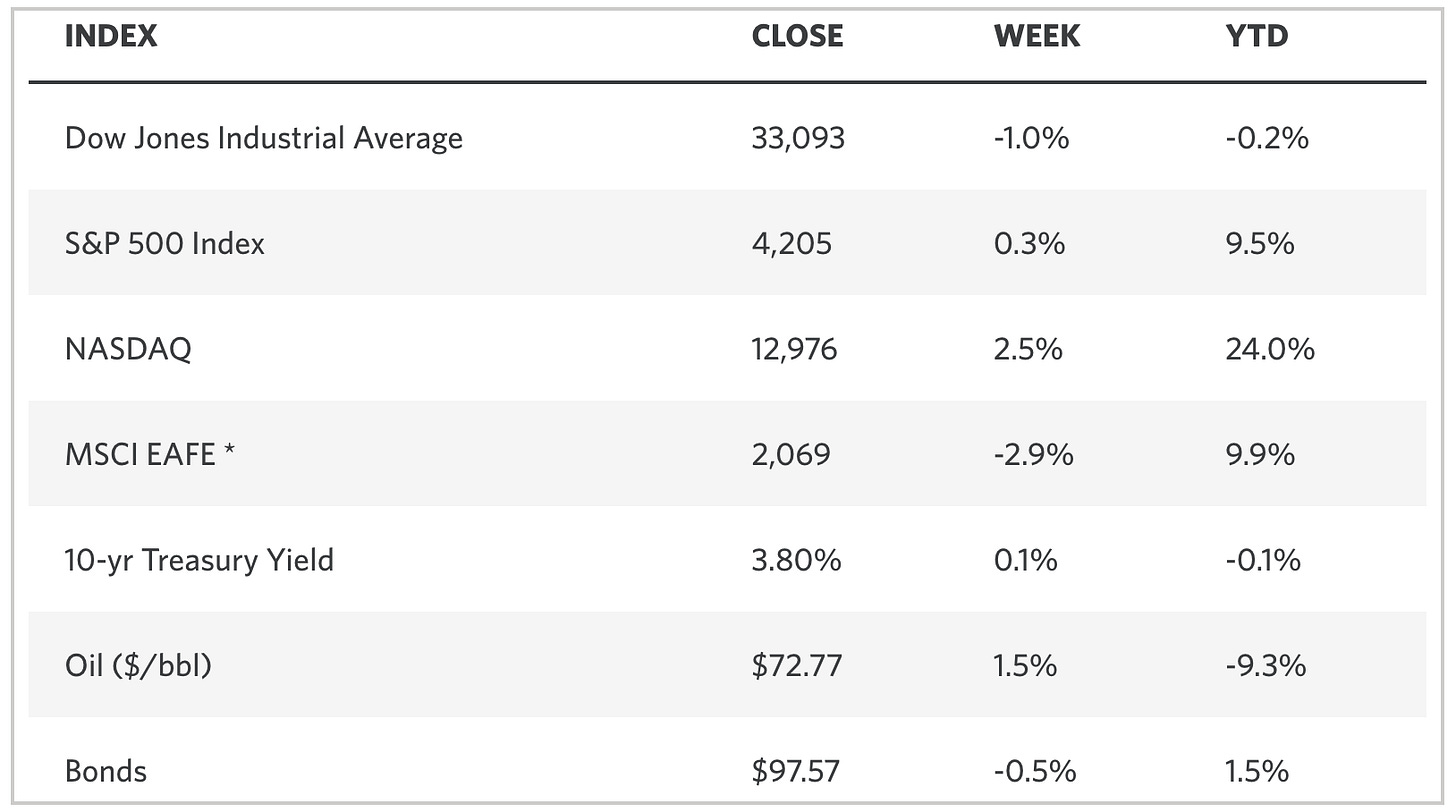

Last week, U.S Stocks remained mixed for the week, with tech stocks gaining during the week. Financials remained muted as investors hoped for a last-minute deal to raise the U.S. $31.4 trillion debt ceiling on talks between President Joe Biden and House Speaker Kevin McCarthy.

Democratic President Joe Biden and top congressional Republican Kevin McCarthy reached a tentative deal late Saturday to raise the ceiling on U.S. government borrowing and avert a default that threatened to send shockwaves through the global economy.

The Dow Jones Industrial Average was down -333.29 points, or 1%, to close Friday session at 33,093.34. The S&P 500 gained 13.47 points, or 0.30%, to finish at 4,205.45. The tech heavy Nasdaq Composite soared during the week on by 317.79 points, or 2.5%, to end at 12,975.69.

Local Markets.

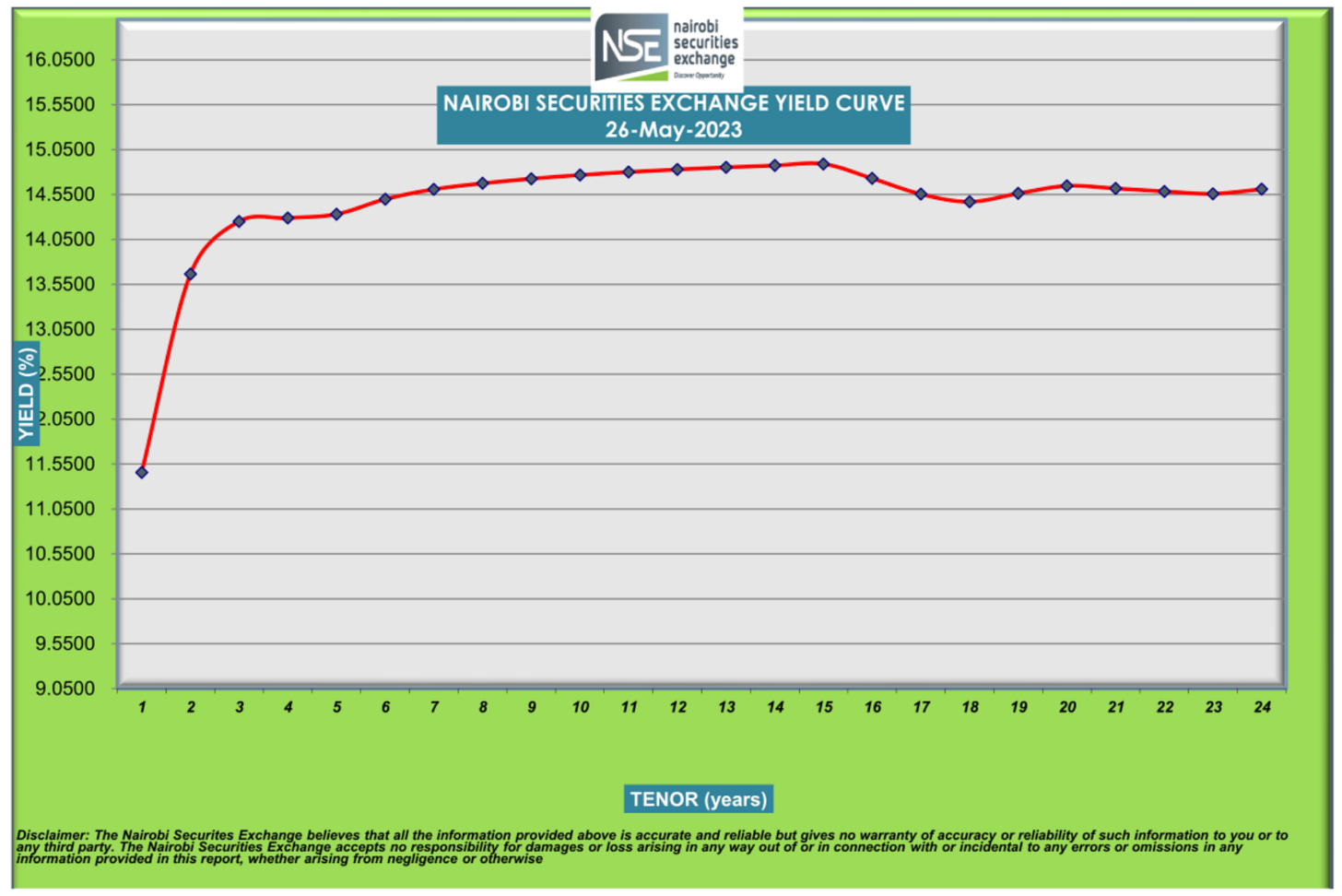

Last week, the Nairobi Securities Exchange was mixed with the benchmark All-Share Index (NASI) and NSE 25 share index posting declines of 0.60% and 1.23% respectively. NASI ended the week at 97.93 points while the NSE 25 index closed the week at 2,540.08 points. The NSE 20 share index however saw a gain of 1.38% to close the week at of 1,467.83 points.

The year-to-date performance of the benchmark NASI, NSE20 and NSE25 share indices stand at -23.1%, -11.2%, and -19.0% respectively.

Last week saw the T-bills undersubscribed for first time in four weeks, at 91.9%, down from last week’s oversubscription rate of 150.1%. The Kenyan shilling extended a weekly loss against the U.S Dollar, with the official Central Bank of Kenya rate at 138.25.

At the start of the week, the International Monetary Fund (IMF) announced that they had reached a Staff Level Agreement with Kenya towards the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements, allowing Kenya to access USD 410.0 million (KES 56.7 Billion) by July 2023.

What Top Cowries are we collecting this week?

Salesforce Inc [NYSE: CRM 0.00%↑] - Salesforce is expected to release their earnings this week, for the fiscal first quarter, the company projects total revenues between $8.16 billion and $8.18 billion (midpoint $8.17 billion). Non-GAAP earnings are expected between $1.60 and $1.61 per share.

Co-operative Bank of Kenya [NSE: COOP] - The Co-operative bank of Kenya had it’s books closed last week, becoming one of the last banks to trade ex-dividends. This week, we will be watching on COOP bank to see if the bank will have prices stability or will we see a decline on ex-dividend closure.

KCB Group Plc [NSE: KCB] - At close of business on Friday, KCB Group announced Former Head of Public Service Joseph Kinyua as its new Chairperson to the board of director. This week, we watch and see if KCB will rebound, the prices for the bank have been hit, with both earnings and investor expectations turning low.

Disclaimer: The writer of this article owns SCOM 0.00 , HAFR , EQTY 0.72%↑ , NVDA -0.72%↓ & AAPL 2.08%↑ shares. This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision.