Meta Stutters, Markets Recover (Slightly) and the Lion's Mane

This week's newsletter is an ode to Pan-Africanism and Afro-Optimism

Football is one of Africa’s real uniting moments. Over the past month we have been treated to the epitome of African football. We’ve seen drama, when a match was stopped twice before end of regulation time, we’ve seen Burkina Faso steal all our hearts by overachieving even with an ongoing coup d’etat back home. Of course there was the very unfortunate stampede at Yoaunde stadium which left 8 people dead and many more injured, condolences to the families.

But all in all this was a major win for the continent. After many naysayers questioned the ability of Cameroun hosting a tournament with all the resurging Covid-19 infections, we have shown that we can organise a successful event (post) covid.

And none was more the winner than Senegal. Coming into the tournament among the favourites together with Ghana (exited in the group stages 😂), Nigeria, Ivory Coast, hosts Cameroun and the dark horses Egypt, their performances flew under the radar until the semi finals and finals. But boy, are they talented. Not taking anything away from Egypt who showed a lot of grind to make it past Morocco in the quarters in extra time, Cameroun in the semis in penalties and taking Senegal all the way to penalties. It seemed inevitable that Egypt were about to win their 8th trophy. In the end, the Lions of Teranga thoroughly deserved the trophy in a fitting tribute to their coach Allou Cisse who as captain of their golden generation about 20 years ago failed to win the tournament.

Afro-Optimism & Pan-Africanism

What does football have to do with anything? you might ask. Afro-optimism is the belief that we will, in our lifetime see Africa make significant progress to solve all her problems especially poverty, diseases, illiteracy among others. We strongly subscribe to this belief and notion.

If football can unite us all across Africa then surely, trade must be made easier to allow for ease of movement of goods across borders. We need to see the African continental Free Trade Agreement come into effect and make it easy and cheap for African countries to trade amongst themselves. There is absolutely no reason for sub 20% intra-africa trade rates.

If music like afrobeats and amapiano and our own gengetone can be listened across all African countries then by all means travel across the continent must be made seamless. No reason to need tens of visa to travel to different countries within the continent.

Our startups must have a single platform, infrastructure and policy environment to allow them to easily scale across all of African to help us solve the problems with the continent especially with poverty and inequalities.

And now for some markets.

Meta: Beginning of the End or Overreaction

Last week we talked about swings and volatility and this was again on full display by the tech heavy NASDAQ. The index surged 3.4% on Monday, posted modest gains on Tuesday and Wednesday, only to fall 3.7% on Thursday before finishing the week with a 1.6% gain on Friday. Talk about swings!

Perhaps the biggest story last week was Facebook (or Meta) reporting that they recorded their first quarterly loss of daily active users for the first time in 18 years. This coupled with the fact that Reality Labs, their AR and VR arm, recorded a $3.3bn loss in Q4 2021 to bring their full year loss to $10bn and the fact that $FB faces further headwinds in their advertising business. Recent Apple iOS changes have decreased the accuracy of ads targeting, increased the cost of driving outcomes and made measuring of those outcomes way more difficult. Not to understate the massive competition from TikTok and Youtube for shorter videos, for the first time in a long time $FB does look post-dated.

Buy the dip?

Earnings Roll On amidst Big Job numbers

As of Friday last week, 56% of companies had reported their results. The performance continued to improve, as fourth-quarter profits at companies in the S&P 500 were expected to increase more than 29%, based on companies that have reported so far and forecasts for firms that haven’t yet released earnings, according to FactSet.

After three straight weekly declines in January, the major indexes posted their second consecutive weekly gains driven by jobs numbers, earnings reports, and the prospects of interest rates hike in March. The U.S economy generated 467,000 jobs in January, widely exceeding economists’ expectations. An upward revision of job totals in late 2021 also provided an indication of a strong labor market.

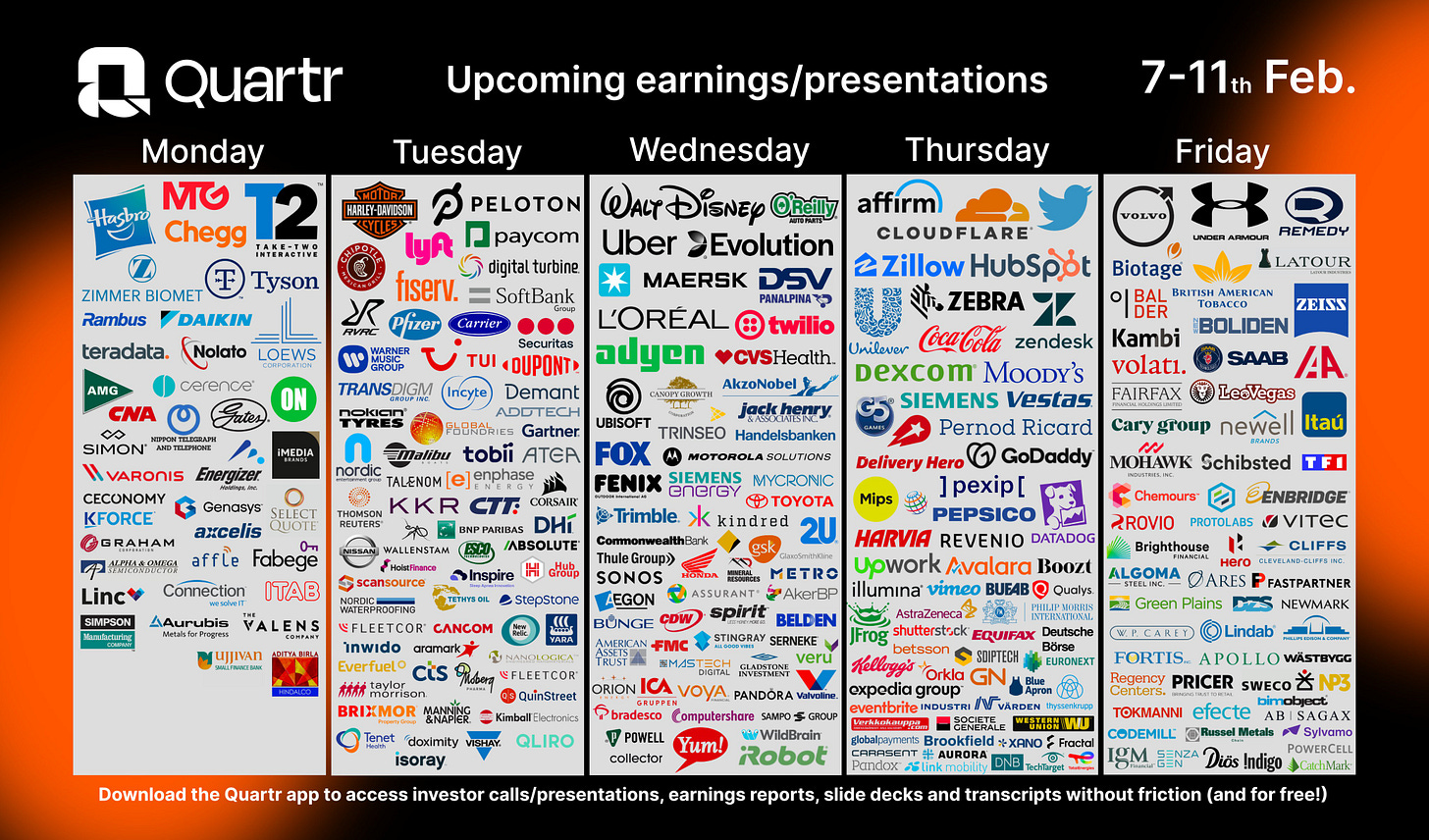

This week marks another busy earning’s calendar with Uber, Pfizer, Coca-cola, Lyft, Twitter and Disney headlining the releases.

What Other Cowries are We collecting?

As we finally move into February, the story so far has been the volatility on the markets. This doesn’t mean we will stop collecting our cowries though 😏. This week we scour for:

Some ETFs - Vanguard S&P 500 ETF($VOO), SPDR S&P 500 ETF Trust ($SPY), iShares Core S&P 500 ETF ($IVV), Invesco QQQ Trust ($QQQ), ProShares UltraPro QQQ ($TQQQ) - Exchange Trade Funds offer investors a great avenue to pick basket stocks rather than focusing on individual stock performance. $TQQQ which is a leveraged ETF gained 83% in 2021 and has an expense ratio of 0.95%, might be worth a look in the short term.

Energy ($XOM, $CVX, ) - Energy sector stocks have been the biggest gainers year to date in a market that has since more drawbacks. We still anticipate this performance to continue.

NSE ($KCB, $EQTY, $SCBK, $EABL) - This week on the NSE we look at a couple of banking stocks mainly KCB, Equity Bank and Stanchart. Stanchart is also a good dividend stock for investors on the Nairobi Securities Exchange. East Africa Breweries Limited stays on our list for the second consecutive week with easing covid restrictions.

More dividend stocks (Coca-cola ($KO), Microsoft ($MSFT), Abbvie Inc ($ABBV) - welcome dividend hunters to our weekly segment where we highlight companies that consistently pay dividends. Coca-cola, The Company ($KO) has paid dividends for 59 years since 1964 with the dividend yield of 2.76% as at Feb 4th 2022. $ABBV has since its inception in 2013 increased its dividend by 225%. The cash dividend is payable by August 16 to stockholders of record at the close of business on July 15. $MSFT is also another interesting dividend stock, paying out dividends every quarter.

That’s it from us at Hisa this week. Last week we promised news, here we go. You can now invest in your favourite US companies from Kenya at a reduced trading commission of 1% down from 2.1%. Also enjoy a new USD wallet, option to deposit funds from your Mastercard or Visa card as well as ability to see the forex rate of the day before placing your orders.

Not yet on Hisa? Download below to start your investment journey.

Disclaimer: The writer of this article owns $KO, $ABBV, $SPY and $MSFT shares. This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision.