Meta, Mana, Shiba & Markets.🚀

Facebook is now Meta, Mana & Shiba are making next level investors!

Hey Hisa fan,

Last week was a unique one. Just when you thought multiverse was an ambiguity by astronomers, well it just got more interesting. Here’s why…

Meta on this Verse

After weeks and months of negative publicity and lots of complaints against the company, and in addition, missing analysts earnings, your favourite, old school social media company announced a massive restructuring.

Facebook Inc., said on Thursday it will be rebranding to Meta Platforms Inc. Mark Zuckerberg, Facebook’s CEO said the move was aimed at bringing together all apps and technologies owned by the company under a new company brand. Facebook said its corporate structure will not change and that it will retain the Facebook app and icon under the current brand.

Despite the name change, Facebook still faces lots of questions from lawmakers and the public over its algorithmic decisions and the policing of abuses on its platforms by compromising ethics for profit.

Metaverse, a term first coined in a dystopian novel three decades ago and technically refers to the idea of a shared virtual environment which can be accessed by people using different devices.

At Hisa, we will watch on Meta Platforms, keen to see which sectors the company will dive in most. Already, there is the direction which the company faces, tech, gaming and fintech but the real outlier holds onto which areas that as not in its current portfolio will the company look to, with healthcare as the most outstanding.

Fun fact/sad fact: Meta in Hebrew means “dead”. Maybe Facebook is a reincarnation.

Decentraland: Mana

Mana sure comes from heaven! See, after the FB declaration, Decentraland, the first fully decentralized world controlled via the DAO went crazy! MANA holds the top position in the metaverse ecosystem which Facebook’s Meta will seek to solidify by building its own extension to the digital world.

The Mana cryptocurrency surged 80% on Thursday after facebook’s announcement and extended this surge jumping over 150% on Sunday.

Mana and other cryptocurrencies such as Sandbox also built on the Decentraland ecosystem were also up. Let’s just say, every asset within Index Coop’s Metaverse Index (MVI), an index that tracks crypto assets and protocols building out the virtual world, rallied for the week.

The quick Question would be, just how long will MANA & other metaverse blockchain-based tokens and crypto’s rally? Will they hold on to this or this could be just a temporary rally and investors could be stuck in value traps?

Coffee Break….The Shiba Army.

If you thought the U.S or China has the largest army, you need to re-check your stats. The Shiba Army has grown strong and continues to grow, with the community focusing on trading and buying the Shiba Inu cryptocurrency coin.

Over the past year, the Shiba coin has jumped over 90 million per cent in returns, with one investor, in what is seen as the greatest investor of all time, coining up to $5.6 billion worth of Shiba from an $8,000 investment on Shiba Inu coin.

It’s been a great run for Shiba Inu, allegedly the doge killer and an army seeking to prove that not only Elon musk can move meme coins with his tweets.

The Earnings Call.

Friday’s earnings were positive with Exxon Mobil and Starbucks leading in delivering upbeat earnings.

Exxon posted the highest jump in quarterly earnings since 2014 in what the company’s CEO termed as a jump backed by the growing rise in commodity prices and streamlined operations.

Earnings per share was at $1.58 per share vs the $1.56 per share forecast average by analysts.

Total revenue jumped by 60% to $73.79 billion, short of the $76.34 billion that analysts on wall street provided.

During the second quarter, the company earned $1.10 per share on revenue of $67.74 billion.

For the year the stock is up 56%, more or less matching the S&P energy sector’s 53% YTD return.

Starbucks posted lower than expected earnings for the fiscal quarter ended 3rd October 2021.

Earnings per share for the period stood at $1.00 compared to the $0.99 cents per share which was expected by analysts.

Net income for the company’s fourth quarter was at $1.76 billion up from the $392.6 million the company posted a year earlier.

Net sales rose 31% to $8.1 billion, falling short of expectations of $8.21 billion with the company attributing this to the drop in sales in China.

Both Starbucks and Exxon announced that they will resume share buybacks in the next quarter. Starbucks committed $20 Billion on Share Repurchases and Dividends Over the Next Three Years while Exxon said it will begin a share repurchase program of up to $10 billion over the following 12 to 24 months.

Markets.

October has been a good month for stocks, unlike what has been historical as most markets reacted to the continued reopening of various economies globally. After a 5.2% correction in September, markets were up nicely in October, with the S&P 500 returning an impressive 6.6% for the month and up over 1.0% last week.

About 55% of S&P 500 companies have reported their earnings so far, with earnings average growth up at a whopping 36% year-on-year ahead of the expectation of 28% from analysts across board.

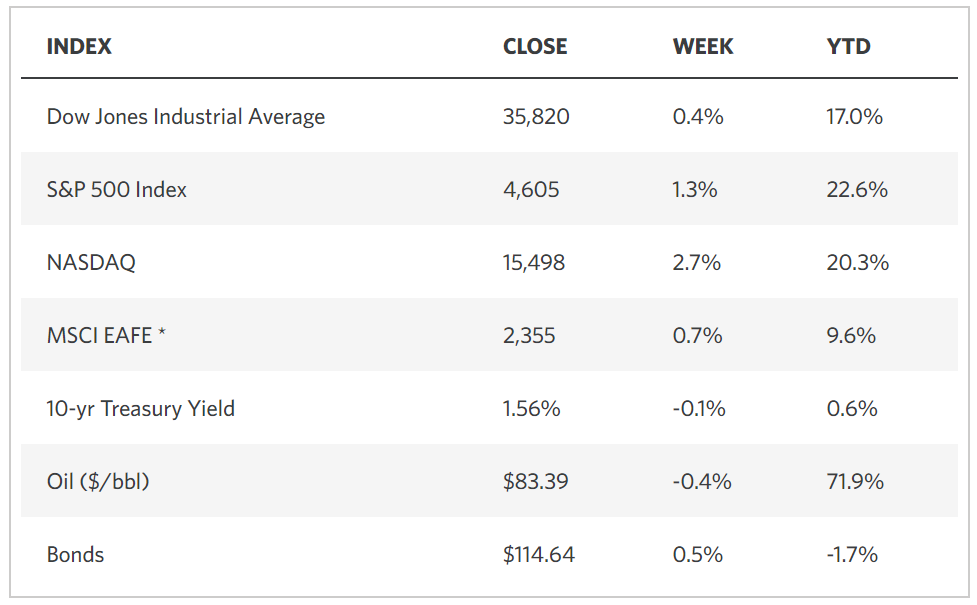

For markets, the Dow Jones Industrial Average extended gains for the week, with a 0.4% gain to 35,819.56, the S&P 500 was up as well for the week 1.3%, to 4,605.38 and the Nasdaq Composite gained 2.7% during the week to close at 15,498.39 basis points.

The local markets were mixed but largely on the red. The All-share index of the Nairobi Securities Exchange (NASI) and the NSE 25 share index were on the red with NASI shedding 0.58 points or 0.32% while the NSE 25 index was down 13.75 or 0.36 to close the week at 177.96 and 3,865.42 basis points respectively. The NSE 20 was however on the rise, adding 0.58 points or 0.03% to end the week at 1,961.33 basis points.

What cowries are we collecting this week?

Microsoft Inc., [NASDAQ: MSFT] - Last week, Microsoft saw open gates and dashed in to surpass Apple Inc [NASDAQ: AAPL] as the world’s largest company by market valuation. Is Apple on relegation mode or was last week just a temporary decline in the favour of MSFT?

Coinbase Global Inc.,[NASDAQ: COIN] - We have talked about cryptocurrencies. Earlier last week, Robinhood markets Inc., [NASDAQ: HOOD] posted lower than expected earnings. Is Coinbase set to go the same way, however, it is great to know that Coinbase does not offer stocks?

Healthcare stocks - Pfizer Inc [NYSE: PFE] & Moderna will be releasing their financials this week. Pfizer starts the earnings on Tuesday with Moderna Inc.[NASDAQ: MRNA] following later on Thursday before the market opens. With the various vaccination levels spiking across the globe, how the revenues for the healthcare companies look like is something our cowrie collectors will be on the watch over.

Kengen Kenya Plc [NSE: KEGN] - With a few local companies releasing their financials over the weekend, investors are watching mostly on Kengen which posted lower than expected financials. Despite a dividend, will the price hold.

How about you, what stocks are you watching for the week? Let us know on the Hisa App.

Disclaimer: This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision. Investing in cryptocurrencies is risky, volatile and returns are not guaranteed.