Markets Rebound, Gamestop Earnings & Markets.

Markets gained, GameStop was on the receiving end while Oracle had bad news for shareholders.

Hey Hisa fan,

The week was a mixed one, with volatility spiking to one of the highest levels in the year. Stocks gained across various global markets, even as news from regulators remained on the offensive. The week ended in a mixed state in anticipation of the Fed meeting next week.

In terms of outlook, investors are seeking to learn just how quickly the central bank plans to finish unwinding its bond-buying program and pick up signs of when it may start to raise rates in 2022.

Fueling the week’s activity was the week’s CPI data showing inflation in the United States remained elevated through November. Headline inflation was at 6.80%, the highest levels since 1982, while core inflation was 4.9% year-over-year, in line with expectations but also elevated.

Earnings:

Gamestop Corporation [NYSE:GME]Gamestop released their fiscal third quarter results at the close of trading on wednesday.

Total revenue grew to $1.30 billion from $1.00 billion a year earlier.

Net loss grew to $105.4 million, or $1.39 per share, from a loss of $18.8 million, or 29 cents per share, a year earlier.

Inventory in the quarter was $1.14 billion, up from $861 million at the close of the prior year’s fiscal third quarter.

Cash and cash equivalents for the period in review was at $1.413 billion.

GameStop’s inventory at the end of the quarter was a reflection of its "focus on front-loading investments in inventory to meet increased customer demand and mitigate supply chain issues."

Shares of Gamestop have been on the decline since the announcement and was further on the hit when it declared that the Securities Exchange Commission had sent a subpoena calling for additional material related to an SEC investigation into the trading of GameStop stock and others.

For the week, GME was down 4.21% to close the week at $159.01 per share with improved resistance on Friday when the stock marginally touched a 2% uptick.

Oracle Corporation [NYSE: ORCL]Software and hardware maker, Oracle, released their fiscal second-quarter earnings after-close on Thursday:

Total quarterly revenues were up 6% year-over-year to $10.4 billion

Cloud services and license support revenues were up 6% to $7.6 billion.

Q2 GAAP operating loss of $824 million and a loss per share of $0.46.

Q2 Non-GAAP operating income was up 6% to $4.9 billion and earnings per share was up 14% to $1.21.

Cloud services and license support revenue $7,554 million and Cloud license and on-premise license revenue $1,237million.

Fusion ERP cloud revenue up 35%, NetSuite ERP cloud revenue up 29%

Oracle’s performance for the quarter was adversely impacted by the payment of a judgment related to a ten-year-old dispute surrounding former CEO Mark Hurd's employment.

Shares of Oracle however stood on the rise after the announcement with the stock clocking a 15.61% weekly gain to close the week at $102.63 per share.

Markets.

Stock markets around the globe rebounded to post stronger returns this week compared to a week earlier. This was in line with various news regarding the vaccine developments by U.K drugmaker GlaxoSmithKline Plc and U.S pharmaceutical giant, Pfizer who claimed to have made various strides against the Omicron Vaccine.

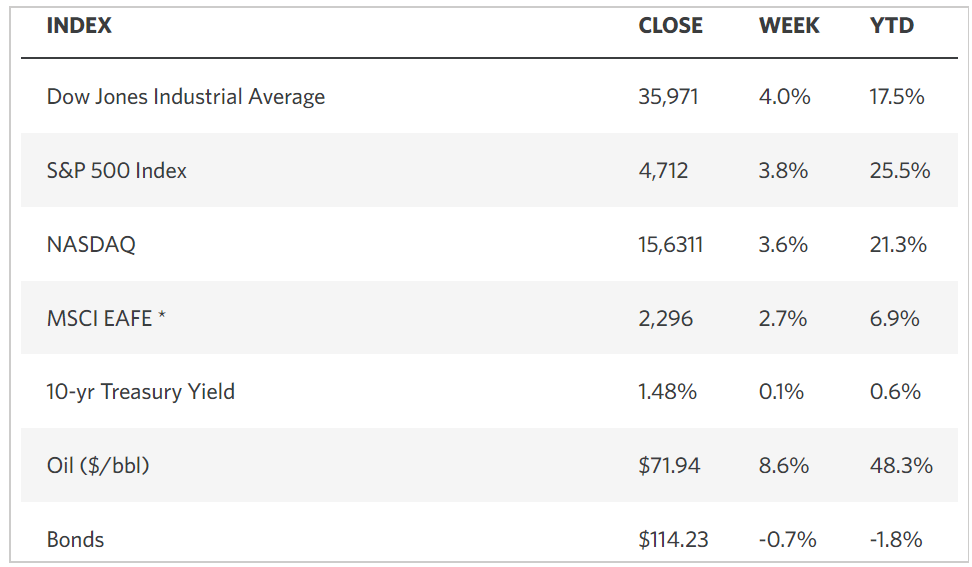

The Dow Jones Industrial Average was up 4.0% to close the week at 35,970.99, the S&P 500 gained by 3.8% for the week at 4,712.02 while the Nasdaq Composite similarly posted gains of 3.6% during the week to close at 15,630.60 basis points.

The local market followed the global trend in posting gains, as decliners of the past few weeks posted gains to lift the benchmarks. The All-share index of the Nairobi Securities Exchange (NASI) added 1.71% during the week to close the week at 162.77 points from last week’s figure of 160.03 points.

The NSE20 and the NSE20 share indices similarly posted a positive incline, with the indices adding 0.92% and 1.71% to end the trading week at 1,856.45 points and 3,594.17 points respectively.

All the data from the local and global markets are available on the Hisa App.

What cowries are we collecting this week?

The Federal Reserve Bank of the United States - The fed will begin their last meeting for the year this Tuesday. While the Feds had already begun tapering, completion and performance dates are important and that is what investors will be looking at.

FedEx Corporation [NYSE: FDX] - FedEx will be releasing its fiscal second quarter for the period ended 30th November on Thursday after market close. For a company whose consensus has been revised downwards by 2.31% over the past two months, how will the financials pun out?

Kenya Power & Lighting Company Plc [NSE: KPLC] - Over the weekend, Kenya had its Jamhuri Day celebrations. President Kenyatta said KPLC was on track to achieve a reduced customer bill through initial actions focusing on system and commercial losses. How will shareholders react to this is on our top cowries this week.

How about you, what stocks are you watching for the week? Let us know on the Hisa App.

Disclaimer: This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision..