Last Week, This Week, Hisa & Markets.

Hey Hisa fan,

The markets have been a mix the previous days, with lots of investor concerns regarding the new Omicron variant. Anyway, let us start with the good stuff.

Hisa is Live!

In case you missed the news! Hisa went live with more features on Wednesday. Among the features that came in with Hisa was the much-awaited trading feature, an option that will allow investors from Kenya to invest in global stocks.

Talk about global, we are kickstarting this with access to the U.S stock markets. You will get to access stocks listed in the New York Stock Exchange and the Nasdaq, the two cumulatively contribute to a third of the world’s stock exchanges.

Hisa Technologies has partnered with Drivewealth & local licensed investment banking giants to ensure that the process of funds collection, trade & settlement remains seamless for you, the investor.

The Week Behind.

The latest Omicron variant has caused lots of jitters across financial markets globally. Concerns about the omicron variant and Fed policy likewise moved equity and fixed income markets.

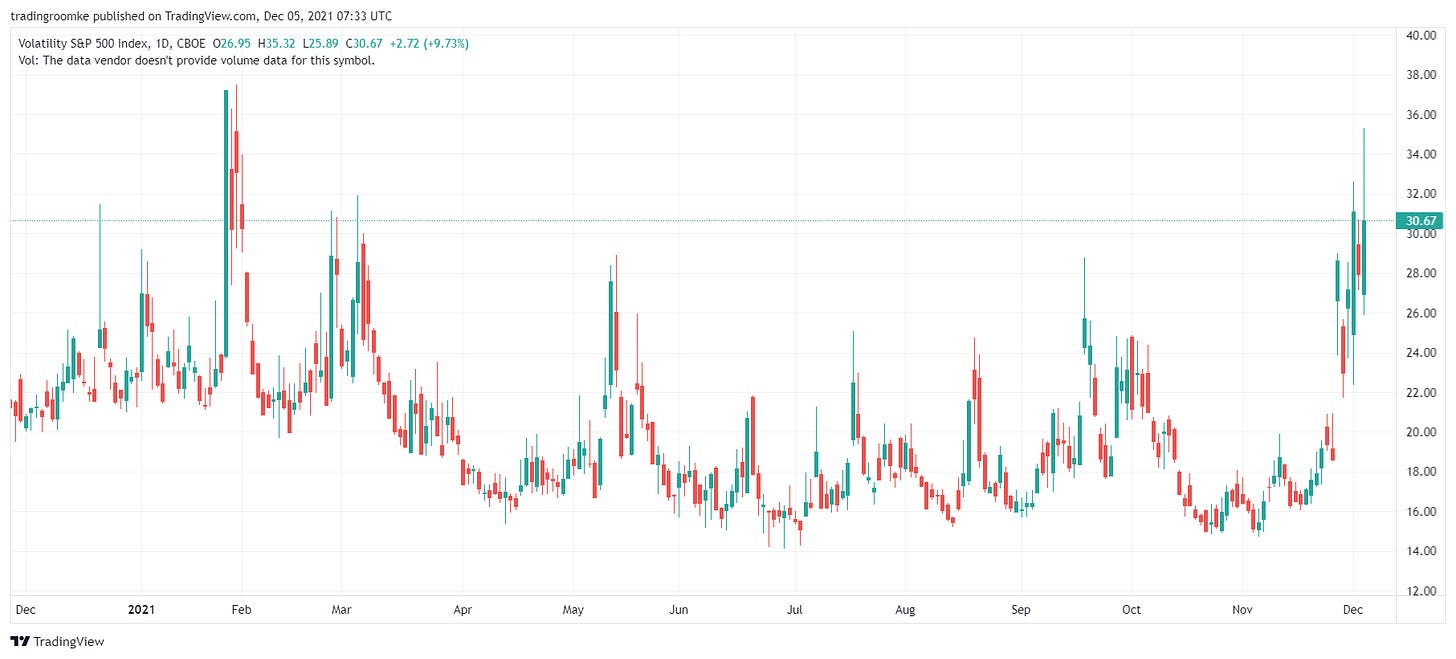

Benchmarks of treasury yields posted flat trends over the week, with short-maturity yields rising and long-term rates decreasing. Most of these concerns were with volatilities indices which hit levels last seen when the delta variant was declared.

The S&P 500 has moved more than 1% for five straight sessions, the longest streak since November 2020. The Cboe Volatility Index (VIX), an index used by investors to analyse the risk levels on wall street, hit its highest level since January on Wednesday. two days before the monthly non-farm payrolls number came out, an action which increased the volatility spike on the markets.

More to markets took turns with the focus shifting from the Federal Reserve of the United States to the real estate crunch in China. On Friday, embattled China’s real estate developer, Kaisa Group said that it failed to receive bondholders’ approval to extend the maturity of a $400 million note which will be due next week. The exposure by bondholders’ now makes Kaisa the latest Chinese property developer to edge closer to default.

Another addition to this was the order by Chinese regulators, ordering Didi Global Inc to delist from the New York Stock Exchange (NYSE). The fall of Didi has caused jitters for Chinese listed companies with Alibaba Holdings Limited [NYSE: BABA] becoming one of the largest U.S listed companies to take a hit.

Coffee Break….KCB & Tanzania.

Kenya’s second-largest bank by assets KCB Group Plc announced on Thursday that it was cancelling the proposed acquisition of the ABC Bank Tanzania. KCB which already completed the majority shareholding acquisitions in a Rwandan based bank.

KCB Group completed the purchase of a majority stake in Banque Populaire du Rwanda Plc(BPR), after acquiring shares previously owned by Arise B.V and Mauritius-based Atlas Mara Limited.

The transaction was to be settled in $8 million cash. However, the actual cash consideration payable by KCB Group would be determined based on the final book value of the bank once the transactions are complete.

The announcement saw KCB’s shares decline 6.16% to Kes 41.15 per share by close of Friday, with the company’s Relative Strength Index (RSI) indicating an oversold status at levels below 28.0317.

Earnings.

Centum Investment Company Plc [NSE: CTUM]Centum Investment Company Plc released their 1H22 before markets opened on Tuesday with the group posting an after-tax loss of Kes 662.11 million, a 66.59% reduction compared to 1H2020's loss of Kes 1.98 billion.

The Trading business for the group was up 180% to Kes 255.33 million (1H2020: -316.79 Million)

The profit from financial services was up 457.55% to Kes 210.46 million from the 37.75 million profit posted in 1H2020.

Centum's net asset value (NAV) remained marginally unchanged with a 0.7% at Kes 41.38 billion.

Centum deleveraged on debt on the company's balance sheet, with the

Assets by the group totalled 47.3 billion as at 1H2022 backed by the 81% growth in real estate, Private Equity and marketable securities.

Total comprehensive loss for the period narrowed down 85.79% at Kes 243.62 million from the Kes 1.71 billion posted in 1H2020.

Earnings per share for the period in review improved by 57.42% to -0.89 per share from -2.09 in 1H2020.

Centum shares reacted negatively to the earnings, with the stock’s price dropping the most on Friday by 3.04% to end the week at Kes 14.35 per share.

Markets.

Global equity markets kicked off December on a mixed grounding, with equity markets logging one of their worst weekly runs in more than six months. The week kicked off with the Omicron variant hitting markets and the Fed holding their stand over tapering, hitting the yields of the world’s largest economy.

The Dow Jones Industrial Average was down 0.9% to close the week at 34,580.08, the S&P 500 dropped 1.2% for the week at 4,538.43 with the Nasdaq Composite dropping 2.6% during the week to close at 15,085.47 basis points.

The local market followed the global trend in posting the red, backed by a decline in the major blue-chips companies posting a decline. The All-share index of the Nairobi Securities Exchange (NASI) decreased by 2.88% during the week to close the week at 160.03 points from last week’s figure of 164.77 points.

The NSE20 and the NSE20 share indices similarly extended their decline, shedding 2.49% and 3.66% to close the week at 1,886.35 points and 3,533.74 points respectively.

What cowries are we collecting this week?

Gamestop Corporation [NYSE: GME] - Gamestop, the stock which was at the centre of the meme craze during last year’s “wall street bets versus Reddit bros” will be releasing results on Wednesday. GME holds an average move of 16.38% in analysts volatility watch will be our top watch for the week.

Twitter Inc. [NYSE: TWTR] - Today marks one week since veteran entrepreneur and co-founder of Twitter, Inc. Jack Dorsey resigned as CEO of Twitter. Parag Agrawal who was picked into the position of CEO is set to pick into a massive restructuring. Twitter’s Chief Design Officer Dantley Davis, who joined the company in 2019, and Head of Engineering Michael Montano, who joined in 2011 stepped down and we will be watching how investors will be reacting to this.

MTN Uganda [USE: MTN] - After an undersubscribed IPO, Uganda’s largest telecommunications company is set to begin trading on the Uganda Securities Exchange today. This will be a milestone, will the share price drop due to the undersubscription or will this be a gain?

How about you, what stocks are you watching for the week? Let us know on the Hisa App.

Disclaimer: This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision..