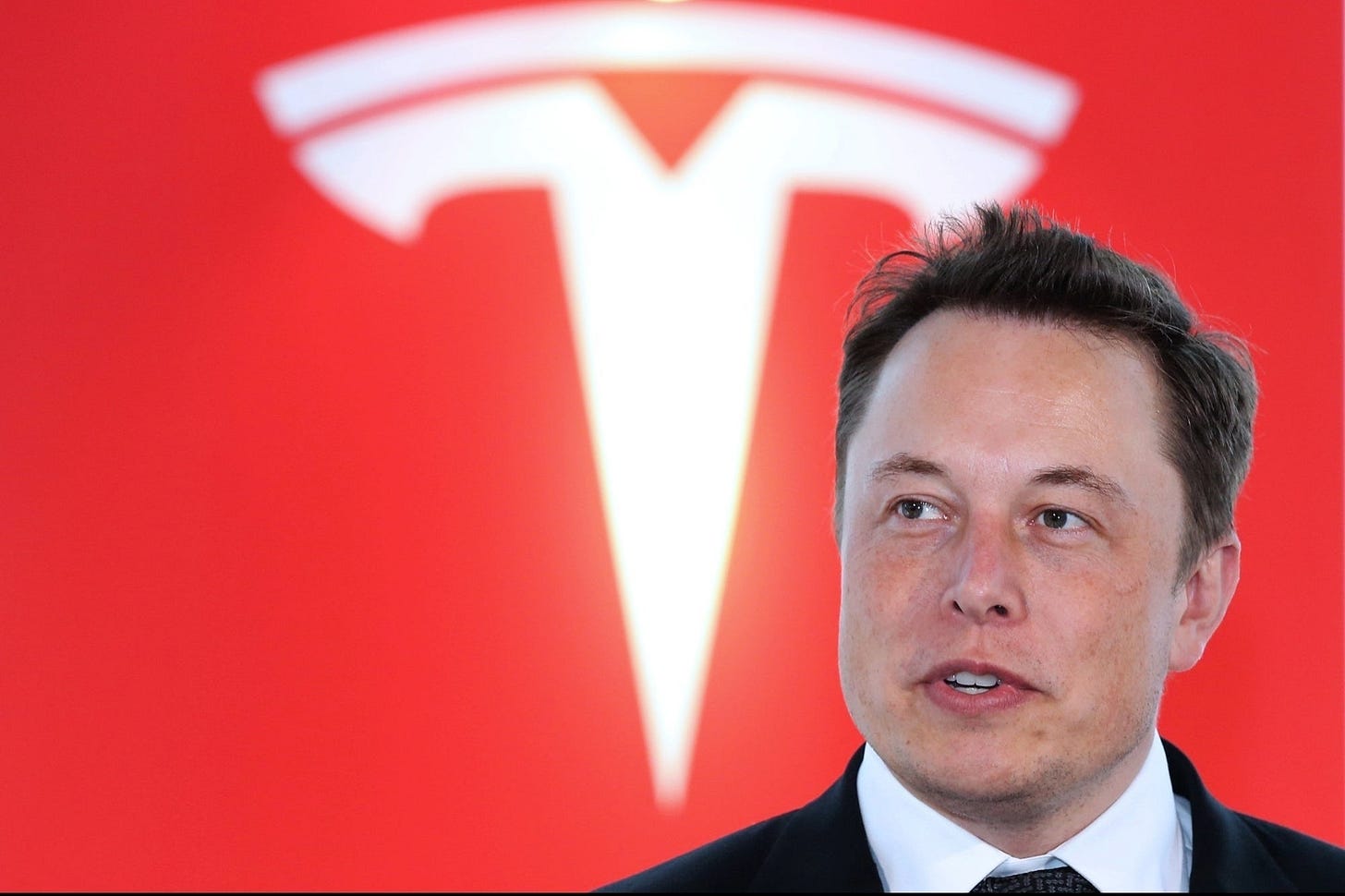

JP Morgan Sues Elon Musk Over Tweets!

Lucid leads the pack of EV stocks. We can now wait for flying EV cars from the future, which is now.

JP Morgan Chase, one of the world’s largest investment banks on Tuesday filed a lawsuit at a Manhattan court against the world’s richest man, Elon Musk.

JP Morgan claims Elon Musk’s tweets have affected the convertible bonds/warrants which the company and Tesla Motors Inc (Now Tesla Inc) entered into in 2014.

In the suit, JP Morgan details how it re-priced its Tesla warrants as a result of Musk's notorious 2018 tweet that he was considering taking the carmaker private, and in fact, Musk said he had secured funding for this action.

This tweet cost Tesla and Elon Musk a whopping $20 million in fines by the Securities Exchange Commission (SEC).

Tesla sold to JP Morgan warrants which were due to expire in June and July 2021. The warrants did expire but JP Morgan claims Tesla is yet to settle these warrants

The agreement on the warrant technically implied that if Tesla’s share price was at or above the strike price of $560 per share on the day the warrants expired in June and July 2021, then Tesla would owe JPMorgan the difference between the share price on that date and $560.

What does this mean?

Tesla’s share price between the period stated was way above the warrant’s strike price and effectively Tesla falls in breach of its contractual obligation to deliver the derived difference from the underlying Tesla shares.

However, in 2019, Tesla complained that JP Morgan’s valuations were based on the volatility of the stock. Despite these allegations, Tesla did not challenge the warrants.

Howdie Elon’s Sales

Away from that, Elon Musk has continued selling more of his Tesla shares this week! We continue to watch and more updates coming to your mail with this.

Meanwhile, What’s up with the EVs?

Not only did Rivian awake the market, but it looks like it gave investors a new sense of direction. Day traders seem to have gone dived fully into EV stocks and this has seen the demand grow exponentially on both the spot and derivatives exchanges. Rivian definitely leads the monthly gainers in EV stocks, lets us wonder about the future!

These are some of the top-performing EV stocks you might want to check out: (Monthly change)

Lucid Group Inc - 119.10%

Rivian Automotive Inc - 70.76%

Nikola Corporation - 21.90%

Tesla Inc - 21.22%

Workhorse Group Inc - 11.15%

Have you bought an EV Stock? Rivian, Lucid, Nio or Tesla? Don’t worry if you missed out, if EV is the future like we all believe, we might be seeing more listings soon, or better; do your research, buy now, hold for later.

Off EV’s What Cowries are We Collecting?

Nvidia Corporation [NASDAQ: NVDA] - Nvidia is set to release its quarterly earnings today. Outside earnings, we are keen on how investors will react to the news that the UK’s completion watchdog is launching a two-phase investigation into Nvidia’s $40 billion acquisition of ARM architecture.

The Home Depot [NYSE: HD] - Home Depot jumped 5.73% during Tuesday’s trading session to touch an all-time high of $392.33 per share after the company posted earnings of $3.92 per share on revenue of $36.82 billion. With the consumer data coming out on Tuesday, will the rally continue today and how will this be for other retail giants like Walmart & Costco?

EV Companies: Tesla, Lucid & Rivian - Yes, we definitely have these three EV musketeers on our watchlist. We couldn’t let them slip.

Ooops, we almost let this one slide, Atlantic Equities has downgraded Robinhood shares, indicating that the company has slowed down in user growth. RH shares were down 3.1% on Tuesday and that could be riding all flat for some time now.

How about you, what are your top cowries for the day? Let us know on the Hisa App.