JP Morgan is Here and What's next on EV'olution.

JP Morgan, the largest bank in the United States and the world’s sixth-largest bank by total assets, announced on Tuesday that it was setting up a regional office in Nairobi, Kenya.

Hey Hisa fan,

Ever wondered what John Pierpont Morgan Sr. was thinking of when he began the journey to reorganise businesses, making them stable and managing them? Well, definitely his investment strategy has grown and the footprint deployed across countries globally. Definitely the growth we all need for companies we invest in.

Long story short, JP Morgan, the largest bank in the United States and the world’s sixth-largest bank by total assets, announced on Tuesday that it was setting up a regional office in Nairobi, Kenya. This becomes the third regional office in the continent after Lagos & Johannesburg.

The move by JPMorgan Chase & Co [JPM 0.00%↑] is a great move for the local financial hub, and is an affirmation that Kenya is headed towards the right direction on being a financial hub in the region.

The EV-Olution!

The EV industry looks to be taking a new turn, headed for speed, as governments seek to have a standard charging stations for all Electric Vehicles, more like the current service stations, which serve all car models. While this is a good move for most EV manufactures, this could be a nightmare to Tesla Inc, whose US chargers are only compatible with its own cars, the supercharging which allows Tesla’s cars to charge in 30 minutes, has often given Tesla an edge compared to other manufacturers.

EV Companies will definitely not be looking at spending on charging stations as a focus from 2024.

The news that is a welcome to consumers wasn’t too good to the market, shares of top EV companies listed across the U.S down.

Tesla Inc. [NASDAQ: TSLA 0.00%↑ ] was down by 1.60% week-on-week and closed Friday at 196.88 USD per share.

Rivian Automotive Inc. [NASDAQ: RIVN] was down by 15.10% week-on-week to close the week at 17.32 USD per share.

Lucid Group Inc [NASDAQ: LCID 0.00%↑ ] also saw its shares decline by 19.41% week-on-week to close the week at 8.51 USD per share.

NIO Inc. [NYSE: NIO 0.00%↑ ] saw shares decline by 7.92% week-on-week to close at 9.30 USD.

Markets

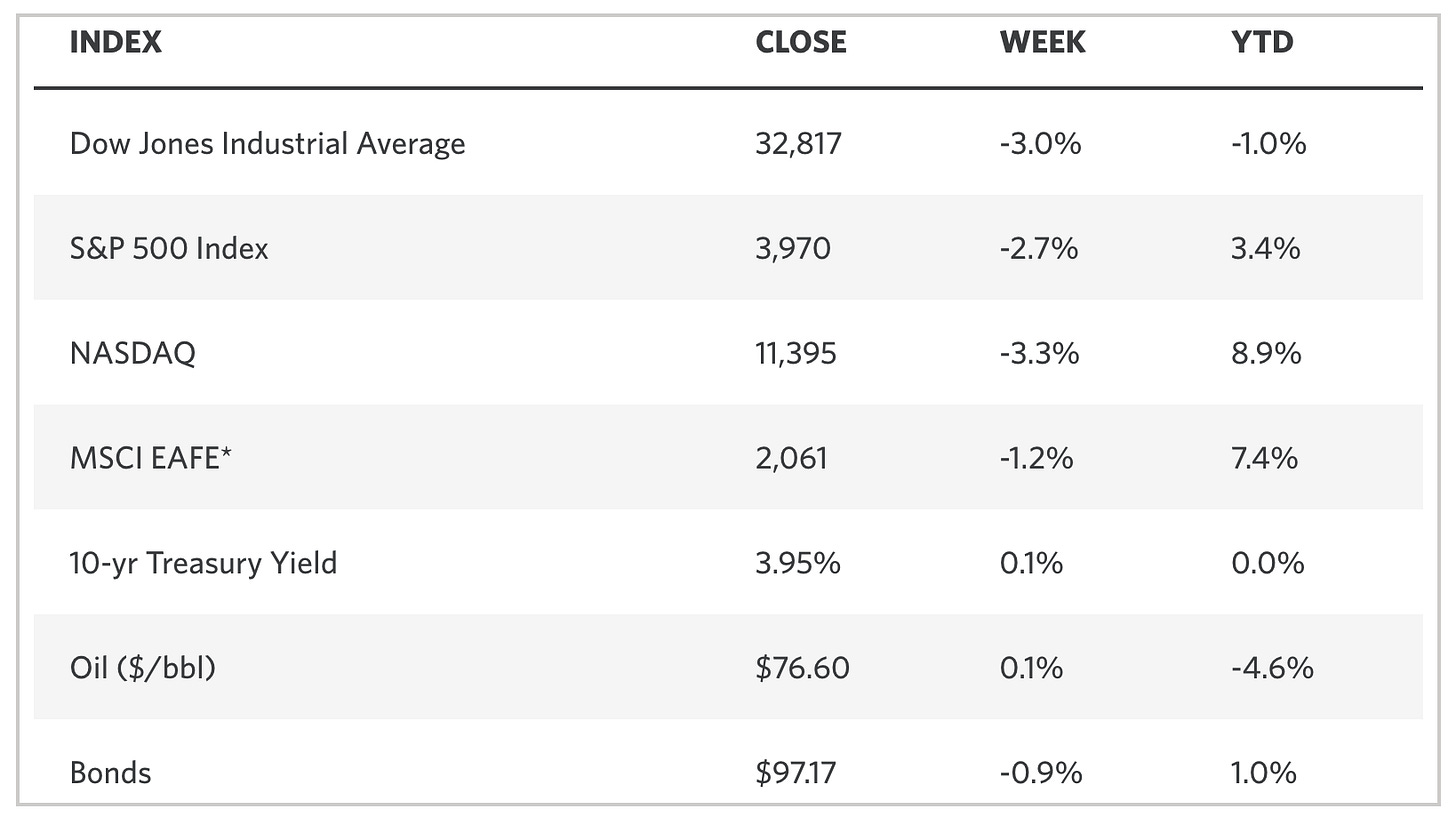

Global markets fell last week as incoming U.S inflation data pushed interest rates higher again and adjusted market expectations for further Fed rate hikes this year. The stock continues its solid rally into 2023, but after a steady rally at the start of the year, the market has shown renewed volatility in recent weeks.

Wall Street's main index plunged on Friday as investors braced for a possible more aggressive rate hike by the US Federal Reserve as US economic data showed resilient consumers.

Wall Street's "fear index", the Cboe Volatility Index [VIX], surged, but remained just below mid-December levels.

The blue-chip Dow Jones Industrial Average posted a 3% drop, its biggest weekly decline since September 2022. This was also the Dow's fourth straight weekly decline, its longest losing streak for nearly 10 months. The Dow closed at 32,817.

The S&P 500 2.7% while the Nasdaq Composite also fell 2.7% and 3.3% to end the week at 3,970 bps and 11,395 bps respectively.

The local bourse posted similar declines in line with global markets, with the benchmark All Share Index [NASI] dropping by 1.55 points or 1.21% to settle at 126.47 bps. The NSE 20 share index was down by 1.51% while the NSE 25 share index dropped 1.25% to close the week at 1655.14 points and 3150.31 points respectively.

Week on week turnover stood at Kes. 812 Million on 37.9M shares, against Kes. 1.3 Billion on 42.8M shares posted the previous week.

On the FX market, the Kenya Shilling maintained the decline stable against major international and regional currencies during the week trading at an average Kes. 126.27 against the US dollar.

What cowries are we collecting this week?

EV Stocks - After last week’s fall, we will keep a watch on EV stocks. Rivian Automotive Inc [NASDAQ: RIVN 0.00%↑ ] will be releasing its results after markets close on Tuesday while NIO Inc. [NYSE: NIO 0.00%↑ ] will release its financial results on Wednesday pre-open.

NSE Banking Stocks - With march coming to a start, we will be watching for heavy activity on stocks for companies listed on the local bourse. Companies that ended their year on 31st December, 2022, are likely to start releasing their results. The banking sector has been loading on activities and they are top of the watch for us.

Exxon Mobil Corporation [NYSE: XOM 0.00%↑ ] - Exxon stated on Friday that they would complete a new crude distillation unit at its 369,024 barrel-per-day (bpd) Beaumont, Texas refinery into full production by the end of the first quarter, increasing production in the U.S. At the same time, the company is facing a growing threat in its oil fields in Kazakhstan due to the war in Ukraine.

How about you, what stocks are you watching for the week? Let us know on Hisa App.

Disclaimer: The writer of this article owns AAPL 0.00%↑ shares. This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision.