‘Inverse’ Jim Cramer ETF, Earnings & Insights on Markets.

Jim Cramer has grown so controversial on stock picks, everyone is hoping to inversely make some mad money out of it.

Hey Hisa fan,

Each week has its comings and this week a new ETF was launched on the U.S markets. As listings came through, the market launched the Inverse Jim Cramer ETF. The Inverse Cramer Tracker ETF (SJIM ) will aim to deliver returns that correspond to “the inverse of securities mentioned by Cramer” by either short-selling his equity picks or buying companies he recommends against, according to its prospectus. Jim Cramer, famous for hosting CNBC’s “Mad Money” show has been on the toss the past year over hist stock picks, most of which have experienced a decline.

Cramer has often emerged as a polarising figure during his long career at CNBC. Critics are often happy to point out when his predictions for specific stocks or the broader economy backfire.

Gas on Cash.

While the global watch was “Jimish” the local economic scene in Kenya was fixed with news on gas as Kenyans battle the rising cost of living. President William Ruto in a Keynote address, informed the country of plans to lower the cost of cooking gas prices by close to 80% by the end of June, 2023.

During the Women Enterprise Fund relaunch, the President announced that the government will eliminate all taxes on cooking gas, including the 8% Value Added Tax. Additionally, the government will provide subsidies for the 6kg gas cylinder, resulting in a projected reduction in the price of at least 80%.

While this remains a good move by the government, locals are asking for more incentives so as to fully reduce the cost of living which has risen threefold over the past one year.

Earnings:

The past week has been a week of earnings, with both global and local firms releasing their financials, here are some of the top companies we were following on this week and how they performed:

Alibaba Holding [NYSE: BABA 0.00%↑ ]

Earnings per shares (American depositary) : 19.26 yuan per share, up 14% year on year.

Revenue: 247.76 billion Chinese yuan ($35.92 billion) up 2% year on year.

Net income: 46.82 billion yuan vs. 34.02 billion yuan, up 69% year on year.

Alibaba's commerce segment fell 1% to $21.19 billion.

The company's cloud segment did revenue of $1.59 billion, up 10% year over year.

Alibaba’s shares were down 1.32% to close the week at 89.70 USD per share. Alibaba’s growth has been strained over the past years as China tightened regulatory oversight over Chinese companies listed on exchanges outside China.

Nio Inc., [NYSE: NIO 0.00%↑ ]

Vehicle deliveries were 40,052 in the fourth quarter of 2022, consisting of 20,824 premium smart electric SUVs and 19,228 premium smart electric sedans.

Vehicle deliveries were 122,486 in 2022, representing an increase of 34.0% from 2021.

Total revenues were $2,329.0 million in the fourth quarter of 2022, representing an increase of 62.2% from the fourth quarter of 2021 and an increase of 23.5% from the third quarter of 2022.

Net loss was $838.9 million in the fourth quarter of 2022, representing an increase of 169.9% from the fourth quarter of 2021 and an increase of 40.8% from the third quarter of 2022.

Basic and diluted net loss per ordinary share/American Depositary Share (ADS) were both US$0.51 in the fourth quarter of 2022.

Kengen Plc [NSE: KGEN]

KenGen Plc released its 1H23 results reporting a 3.2% y-o-y decline in PAT to Kes 3.3 Billion.

Total other income came in at Kes 53.0 Million (from a loss of Kes 121.0 Million in 1H22.

Total operating expenses went up by 15.7% y-o-y to Kes 18.1 Billion mainly driven by higher depreciation & amortisation costs.

Total assets rose by 1.1% year-on-year to KES 507.8 BN while total liabilities increased by 1.7% year-on-year.

Cash and cash equivalents at the end of the year decreased by 37.0% year-on-year to Kes 10.0 billion due to a 45.8% year-on-year decline in net cash generated from operations to Kes 5.5 billion.

Finance costs rose by 30.7% year-on-year to Kes 1.2 Billion while Finance income sank by 1.1% year-on-year to KES 1.0 billion.

Other Key Earnings

Costo Wholesales Corporation [NASDAQ: COST 0.00%↑ ] - Fiscal second-quarter sales jumped 6.5% to $54.24 billion.

Salesforece Inc., - [NYSE: CRM 0.00%↑ ] Salesforce beat on fourth-quarter revenue, posting a 14% year-on-year growth to $8.38 billion.

Rivian Automotive Inc., [NASDAQ: RIVN 0.00%↑ ] - Adjusted loss before interest, taxes, depreciation and amortisation of nearly $5.2 billion in 2022.

Kenya Power & Lighting Company Plc [NSE: KPLC] - 1H22 revenue grew by 3.7% to KES 86.7 billion characterised by a 4.4% rise in unit sales to 4,764 GWh.

Markets

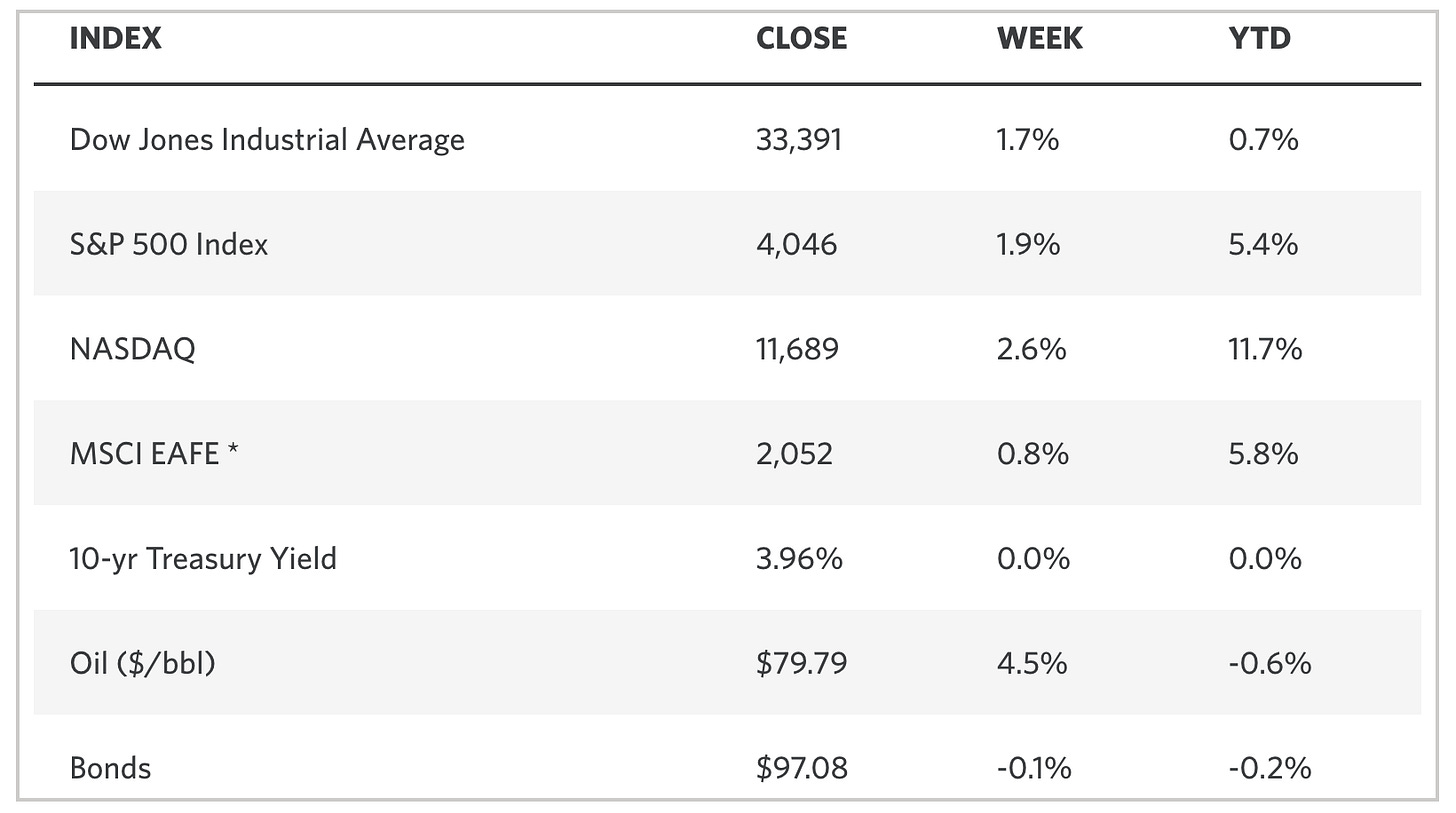

The Dow Jones Industrial Average [ DJIA 0.00%↑ ] gained 377.19 points, or about 1.7% to 33,390.97. The S&P 500 jumped 1.91% to 4,045.64, and the Nasdaq Composite climbed 2.6% to 11,689.01.

Energy Stocks were the most resilient, whereas Meta Platforms Inc [ META 0.00%↑] helped communication services gain. Stocks on the utility sector mainly flopped compared to the overall performance of the U.S Markets.

Local Markets

The benchmark indices all lost ground during the week, posting a downward movement. The NSE 20 share index shaved off 21.05 points or 1.27% to stand at 1634.09. All Share Index (NASI) edged down 0.30 points or 0.24% to settle at 126.17. The NSE 25 Share lost 16.99 points or 0.54% to settle at 3133.32.

Notable action was on the banking sector, with Absa Bank Kenya being the most actively traded counter in the banking sector with 11 million shares valued at Kes.142 million exchanging hands. The stock closed Friday at Kes.12.40 per share.

What cowries are we collecting this week?

More Earnings - Local and Global stocks are on the edge of releasing earnings and we will be keeping you all informed on which stocks are making the greatest moves at Pre-open and after-close.

JD.Com [NASDAQ: JD 0.00%↑ ] - Chinesse E-Commerce giant JD.com is set to release earnings before market opens on Thursday. The stock is currently trading at USD 47.90 per share and we will be looking at just how the revenues impact share price performance.

Currency Markets [FX]- The US Dollar has been holding safe over other major currencies the past few months, we camp at the USD/KES watch this week and share with you the reports on how they currency markets perform this week.

How about you, what stocks are you watching for the week? Let us know on Hisa App.

Disclaimer: The writer of this article owns AAPL 2.08%↑ shares. This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision.