Credit Suisse, KCB Slashed Dividend & The Latest on Markets.

The week was long! A market turmoil, a local market drag amidst banking releases and a "supportive" global financial system.

Hey Hisa fan,

The week has been long! Let’s kickstart from where we left last week, the global banking system and the shockwave left by the collapse of Silicon valley Bank. Global markets remained in a mix of investor uncertainty amidst a wake of investor concern on the banking sector.

Credit Suisse was a bank on the brink of collapse this week, after the bank’s biggest backer — the Saudi National Bank — said that it wasn’t prepared to put up more money after buying a near-10% stake for $1.5 billion in the bank last year.

Why is Credit Suisse a concern?

Credit Suisse is one of the biggest financial institutions in the world. It is categorized by the Financial Stability Board, an international body that monitors the financial system, as a “global systemically important bank,” along with just 30 others, including JPMorgan Chase, Bank of America and the Bank of China.

2014 - Credit Suisse pleads guilty to federal charges on U.S. clients tax evasion.

2019 - Credit Suisse involved in accounting scandal at Luckin Coffee.

2020 - Credit Suisse CEO Tidjane Thiam resigns after spying scandals involving top bank officials.

2021 - US hedge fund Archegos Capital collapses, causing Credit Suisse $5.5 billion in losses.

2022 - Credit Suisse is hit by social media speculation that it was on the brink of collapse, an investor pull is done.

2023 - Credit Suisse’s stock plunges to record lows after it posts its biggest annual loss since the financial crisis in 2008.

Conclusion

Credit Suisse might have received a lifeline on Thursday, with the Swiss Central Bank saying they would lend the bank 50 million dollars to shore up its deposits and capital reserves. While this lifeline has saved the global banking crisis from a meltdown, the question could be, what next? What lies on the next one is the big question. Could other banks be struggling? Is this just a beginning?

Coffee Break.

Take a break, ever wondered how many games you can play with your friends, family and peers to learn about money? Here’s what our team at Hisa was learning this week.

Last Week’s Key Earnings:

Local listed banks continued to release their earnings as the race to 31st March deadline nears. KCB Group Plc, Standard Charted Bank Kenya and Cooperative bank of Kenya were some of the top companies releasing their financial during the week.

KCB Group Plc [NSE: KCB] KCB Group Plc was key on watch, as the company cut its annual dividends by 33%. Here were the Key highlights off KCB.

Profit after Tax Increased by 28.4% from Kes. 15.3 billion to Kes. 19.6 billion

Revenue was up 16.8% to Kes. 59.8 billion from Kes. 51.2 billion

Costs were up 20.3% to Kes. 27.3 billion from Kes. 22.7 billion.

Total Assets Stood at Kes. 1.21 trillion, up 18.4%.

Loan and advances - Grew 27.8% to KES.863.3Bn (KES.675.5Bn FY2021) mainly driven by organic growth (17%) from the Kenyan unit and inorganic growth (10%) from the acquisition of Trust Merchant Bank (TMB).

Customer Deposits Increased to Kes.908.6 billion, a 15.6% rise from Kes.837Bn - FY2021). (22.3% inorganic from TMB) (13.3% - organic Other subsidiaries).

Non-Funded Income (NFI) - Up 39.8% to KES.43.3Bn (FY2021 - KES.24.5Bn) which was in line with our forecast of KES.40Bn - KES.45Bn.

Co-operative Bank of Kenya [NSE: COOP]Co-operative bank saw its dividends gain with the FY2022 releases, pushing the stock up.

Profit After Tax (PAT) was up a 33.2% year-on-year (YOY) to Kes.22Bn (FY2021: KES.16.5Bn).

Loan and advances stood at Kes.339.4Bn (KES.310.2Bn FY2021) on increased lending to the SME and MSMEs.

Non-Funded Income (NFI) was up 32.7% to Kes.25.7Bn (FY2021 KES.19.4Bn) largely attributed to. a 65.6% growth in foreign exchange trading income from KES.19.4Bn to KES.25.7Bn.

Gross Non-Performing Loans (NPLs) increased by 5.2% to KES.52.3Bn (FY2021: Kes.49.7Bn.)

Co-op declared a final dividend of Kes.1.5 per share.

Other Key Earnings last week:

ABSA Bank Kenya Plc [NSE:ABSA] - 34.2% y-o-y growth in after-tax profits to Kes 14.6 BN, mainly steered by a 27.9% growth in net interest income to Kes 32.3 BN and a 17.2% y-o-y increase in non-funded income to Kes 13.7 BN.

Standard Charted Bank Kenya Plc [NSE: SCBK] - Profit after tax grew by 38% y-o-y to Kes.12.44 billion. SCBK declared a final dividend of Kes.16 per share, pushing total dividends for 2022 at Kes 22.00 (FY2021: DPS Kes 19.00)

Markets

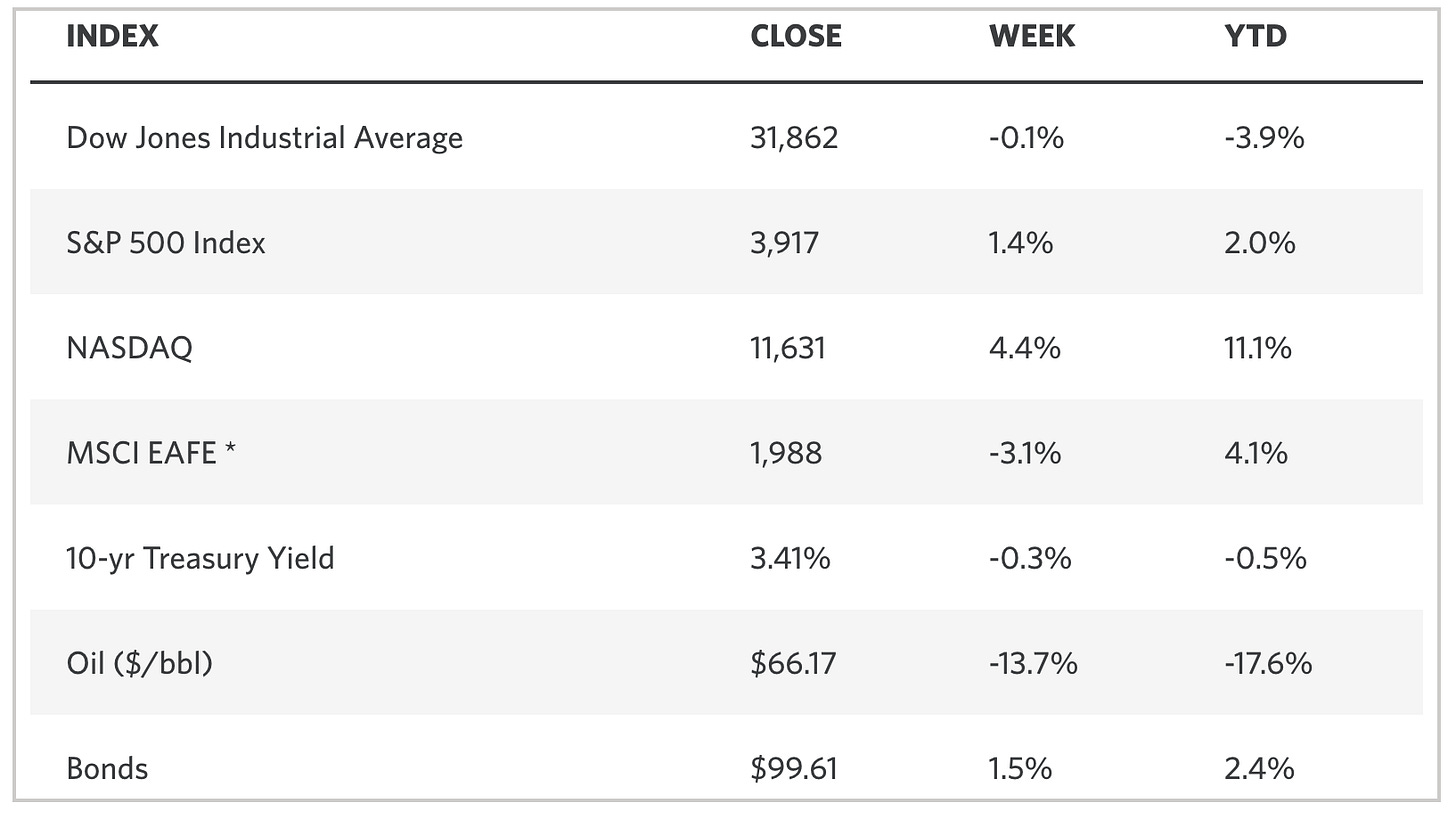

U.S Stocks posted a mixed trading week, after last week’s plunge following the collapse of Silicon Valley Bank and other emerging market concerns, Also growing concerns were a steeper slowdown in the economy, and optimism that the Federal Reserve would be forced to moderate or even pause in its rate-hiking cycle.

The S&P 500 and the Nasdaq Composite Index were the gainers, posting gains of 1.4% and 4.4% respectively, while the Dow Jones closed 0.1% lower during the week.

Local Markets.

Stocks on the Nairobi Securities Exchange remained on a downward trend during the week, with benchmark NASI, shedding by 12.3% to end the week at 103.41. The NSE 20 and NSE 25 similarly closed lower, with a 4.9% and 9.7% decline to end the week at 1530.17. and 2706.28 respectively.

The equities market performance was mainly driven by investor flight as large caps continued to post losses, stocks such as Safaricom (-20.6%) , and banking stocks: KCB Group (-17.22%), Equity Group (-11.28%) led the drag on the market.

What cowries are we collecting this week?

Equity Group Holdings Plc [NSE:EQTY] - Member is the only tier I bank yet to release it’s results. With just 10 days left, Investors are getting anxious of the wait. We will keep watch of the stock performance and the financials this week.

GameStop Corporation Inc., [NYSE: GME 0.00%↑ ] - Gamestop Corporation is expected to report earnings on March 21 after market close. The report will be for the fiscal Quarter ending Jan 2023. We will be watching on how investors react to the stock’s financials.

The Federal Open Market Committee [FOMC] - The Fed are due to meet this week on Tuesday, March 21 to Wednesday, March 22. The Hisa team will be watching if the rates will go up, or there will be a decline.

How about you, what are your top cowrie collections this week? Let us know on the Hisa App.

Disclaimer: The writer of this article owns SCOM 0.00 , FTGH, EQTY, NVDA -0.55%↓ & AAPL 2.08%↑ shares. This article does not constitute any investment recommendations. Investors and the general public are advised to do their own research before making any investment decision. Past performance does not imply future returns.